When can you withdraw, how is the money taxed, and how to avoid it

What is an EPF

Tax is generally applied on premature withdrawal of the EPF under certain circumstances. Currently, an employee’s own contribution to the EPF account is not taxable. However, an employer’s contribution to the EPF account is taxable if it exceeds Rs 7.5 lakh in a financial year.

The EPF fund is non-taxable even if withdrawn before its lapse, subject to a withdrawal limit and certain conditions for the following reasons, explains Sandeep Bajaj, Managing Partner, PSL Advocates & Solicitors

-

Medical Needs- An employee may take relief from the provident fund of their share plus interest, or six times their monthly wage, whichever is less, to pay for medical care. -

Repayment of Home Loans- If the property is registered in their personal or owned jointly, the member may withdraw up to 90% of the corpus to pay off the outstanding home loan. -

Wedding- It is possible to withdraw 50% of the employee’s contribution plus interest in this case. However, to be qualified for withdrawal, at least seven years of service must have been completed. -

•Retirement- A person may take their provident fund corpus once he is 58 years old. The employee may withdraw up to 90% of the amount in the provident fund. -

Unemployment- After one month of leaving a job, a subscriber may withdraw 75% of their EPF balance by EPFO regulations. The remaining 25% of the EPF balance may be withdrawn after unemployment for a period of 2 months.

To be eligible for this withdrawal, you need to have completed five years of membership. The maximum amount that can be withdrawn is limited to 24 times the monthly salary for purchasing the house site or 36 times the monthly salary in case of the purchase of a house and construction of a house. The facility can be availed only if the purchase/construction is in the name of the PF account holder and his/her spouse.

You need to complete five years of membership. The maximum amount that can be withdrawn is equal to 12 times the monthly salary. This facility is applicable only for the house in the name of the PF account holder and his/her spouse.

Your EPF payout has 3 components, as explained by ClearTax

Interest on your/employee’s contribution– This portion is taxed as income from other sources.

At the time of making a contribution the amount contributed by your employer is tax-free if it is within the limit specified, which is 12%. Any amount contributed by your employer over and above 12% is taxable in your hands as ‘Income from Salary’’. An employee’s contribution towards PF can be claimed as a deduction under Section 80C. Since, the maximum deduction allowed under section 80C is Rs. 150,000, therefore that is the maximum you can contribute.

Employer’s contribution to EPF is taxable if it exceeds Rs 7.5 lakh in a financial year

“Tax is generally applied on premature withdrawal of the EPF under certain circumstances. Currently, an employee’s own contribution to the EPF account is not taxable. However, an employer’s contribution to the EPF account is taxable if it exceeds Rs 7.5 lakh in a financial year,” said -Sandeep Bajaj, Managing Partner, PSL Advocates & Solicitors.

For calculating the period of five years of service, it is not necessary that service should be continued with the same employer. Period of previous employment is also considered for this purpose.

You get an exemotion by filing Form 15 if your income for that year was less than the taxable limit and if one withdrew more than Rs 50,000 and worked for the company for less than five years. If one’s withdrawal exceeds Rs 50,000, and an EPF balance is withdrawn before five years of service, TDS is deducted at 10%.

TDS will be withheld at the 20% if PAN is not given. If there is no tax on one’s entire income, including EPF withdrawal, one may file Form 15G/15H. If Form 15G or Form 15H is filed, TDS is not applied.

E.g. If one withdraws Rs. 10,000 from their EPF, the tax is 20% of Rs 10,000 ( Rs 2,000) if PAN & 15G/ 15H Forms are not given; however, the same reduces to Rs 1,000 if PAN is present and completely exempted when Form 15G/ 15H is submitted along with it.

Finance Minister Nirmala Sitharaman reduced TDS rates from 30% to 20% on the taxable portion of EPF withdrawal in non-PAN cases during the presentation of Union Budget 2023-2024.

Tax when withdrawal is made after 5 years of continuous service

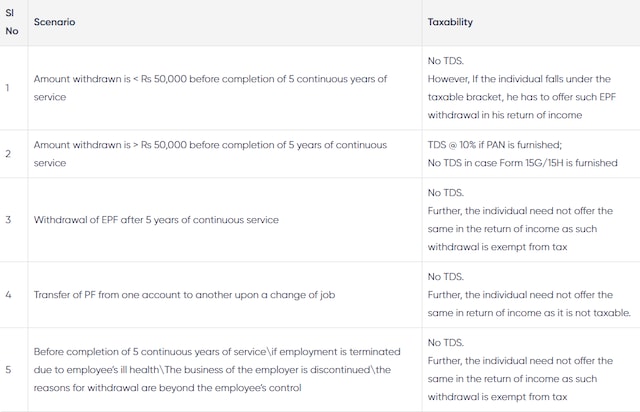

The following table by ClearTax will help you easily understand the taxability on withdrawal of EPF:

Some of the instances pertaining to the treatment of TDS are explained below:

No TDS will be deducted in such a case. Since the withdrawal is tax-free, the person does not need to include it in their income tax return.

Before completing five consecutive years of service, a sum of Rs 50,000 was withdrawn-

EPF withdrawal after five years of continuous service-

Transferring PF from one account to another after changing jobs-

In case the entire balance in EPF account of the employee is transferred to his/her NPS account, then such transfer is exempt from TDS and will be excluded from the computation of the total income.

How to avoid paying tax on the withdrawal of EPF

The taxpayers can postpone withdrawals from their account for five years (constant employment with all employers); after which, there won’t be any taxes due on such withdrawals.

The taxpayers must ensure that they do not withdraw an amount exceeding Rs. 50,000/- within the stipulated time period of five years to avoid paying taxes on such withdrawals.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India