What they are & How to maximize card reward points without having to overspend

Credit card reward points are the returns on the money you spend on your credit card. These are offered for a specified amount you spend, for instance, 2 reward points for every 100. Different credit cards offer varying reward rates, across specific or multiple categories, brands, etc. For instance, if you frequently travel, you can earn points by booking flight tickets with your card and later redeem them at airport lounges, enhancing your travel experience

1. Don’t spend money just for the sake of earning rewards

“Many credit cards offer higher reward points without requiring you to spend more. You must choose credit cards that align with your spending habits and offer rewards that are valuable to you. Look for cards with generous reward programs, bonus categories, or cashback options that match your regular expenses. You must know where you typically spend your money and what types of rewards you would like to earn. This will help you narrow down your options and opt for a credit card that is fit for you,” said Adhil Shetty, CEO of BankBazaar.

2. Understand the types of credit cards for higher rewards points and pick a card that offers rewards matching your lifestyle

Co-branded Cards: Co-branded credit cards are issued in partnership with specific brands. They give higher reward points or cashback for purchases made at the partnering brand’s outlets or website. For example, airline co-branded cards may offer bonus points for flight bookings or retail co-branded cards may offer extra rewards at affiliated stores.

Premium or Lifestyle Cards: Premium credit cards often come with higher annual fees but also offer enhanced rewards and benefits. These cards may provide elevated reward rates across various categories or exclusive privileges such as airport lounge access, concierge services, or complimentary hotel stays.

Travel Rewards Cards: Travel-focused credit cards often offer higher rewards for flight bookings, hotel stays, or travel-related expenses. These cards may provide bonus points for specific airlines or loyalty programs, access to airport lounges, or travel insurance benefits.

If you use your credit card within the first three months after getting it, some banks may give you bonus points as a welcome gift. You can earn even more points if you spend money shopping at partner stores, eating out, or attending entertainment events. Moreover if you add an authorized user, many credit cards give you additional bonus points, usually around 5,000, for adding an authorized user who makes purchases in the first few months.

Most credit cards offer extra rewards on select categories such as online shopping, groceries, departmental store spends, etc. When choosing a rewards credit card, users should check if the bonus categories align with their spending habits.

For instance, Airtel Axis Bank Credit Card offers 25% cashback on Airtel bills paid via the Airtel Thanks app and 10% cashback on utility bills paid via the app. So, if you pay an Airtel Mobile bill worth Rs. 1,000 and Rs. 2,500 electricity bill via the Airtel Thanks App, you will get Rs. 250 cashback for each of these payments, adding up to a saving of Rs. 500,” explained Rohit Chhibbar, Head of Credit Cards, Paisabazaar.

In addition to the bonus categories, cardholders should also know about the excluded categories where they would not get any benefits. “Utility bill payment, for instance, is excluded from the reward benefits of most credit cards. So, despite being a major part of your monthly expenditure, utility bills may not help you earn rewards. Some cards also put capping on the value-back that you can earn which is also a crucial consideration when strategizing the reward earnings,” cautioned Chhibbar.

5. There is no “best credit card” as such

One-size-fits-all approach doesn’t work in this case, as customers have varied requirements, spending behaviours and they hail from varied income categories and profiles.

“Lot of deals and discounts can be availed through credit cards such as up to 10X cashback i.e. 30% discounts on products like phones, laptops, apparel etc. One needs to check for the vouchers on the websites of these card companies.

Damani advises the rich to explore premium and super-premium cards like HDFC Infinia or the Axis Magnus. On HDFC Infinia, savings can be up to Rs.3 lakh annually based on its current cashback structure. Therefore, it’s advisable that customers first ascertain their spending habits and then opt for credit cards which offer reward points related to those consumption avenues

5. Pay your rent through your credit card

You should pay your rent and other utility bills through your credit cards. For instance, websites like Cred, NoBroker and RedGiraffe allow you to do so and you can in return earn some rewards too. Moreover, Since credit utilisation is increased by paying the rent with your credit score, this will have an impact on your credit score. The credit utilisation ratio is an important factor to determine your credit score.

6. Use the card’s reward platform

Each time you make a purchase online, the possibilities of earning additional points also go up. Most credit card banks have their own shopping portals from which purchases can be made. Or, you can shop at online stores that offer the option of cashback.

Flights: We can book both domestic and international flights. SmartBuy acts as an aggregator and lists flights from OTAs EaseMyTrip, Yatra, Cleatrip, and GoIbibo.

IGP Gifting

6. Sign up for emails with the credit card to take advantage of specific offers.

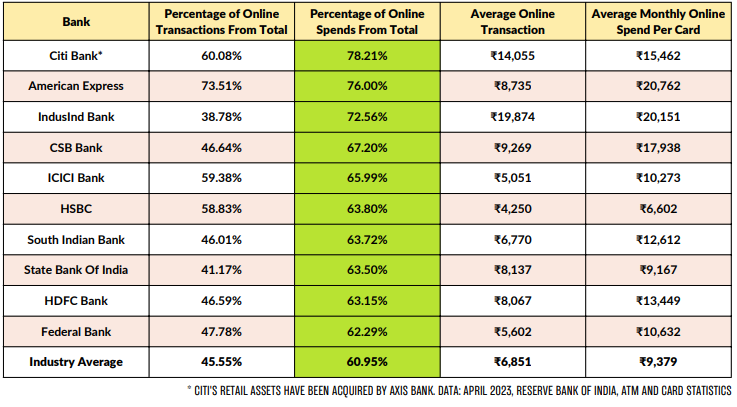

India’s most loved credit cards for online purchases, according to BankBazaar are:

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India