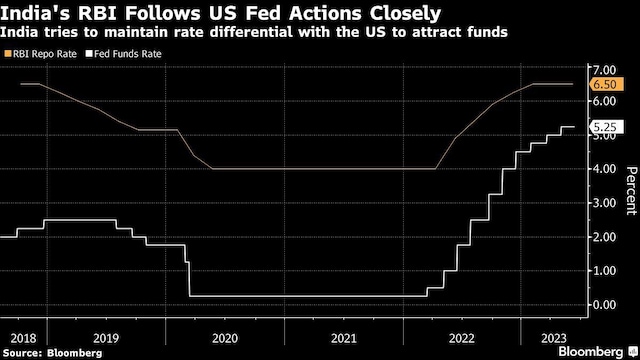

Unlikely that the RBI will precede the US Fed in pivoting to a rate cut

Economists tracking India aren’t altering their forecasts for a rate cut as yet, which they expect will come after the US starts easing. But the possibility for the Reserve Bank of India to ease policy in the next 12 months is much lower with traders in the US markets pulling back wagers on any cut.

RBI Governor Shaktikanta Das needs to keep financing conditions easier to aid growth, while also maintaining adequate rate differential to attract foreign portfolio flows. He kept rates on hold last week and has an eye on inflation, echoing most global policymakers who are still waging a war on still-elevated food and fuel prices.

India also does not need to hurry on carrying out rate cuts as economic growth stays strong. At 7.2%, Asia’s third largest economy is the world’s fastest growing region.

Most traders in India’s bond market were not expecting a rate cut by the RBI before the end of the year even before the Fed’s hawkish pause. The benchmark 10-year Indian bond yields climbed 2 basis points to 7.02% while swap rates were little changed after the Fed announcement.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India