Should you pick one over a credit/ debit card?

Debit cards are cards which are linked to your bank account. Whatever money you have in your account, you can use that money abroad, provided your debit card is internationally accepted. You can only use funds in your bank account through your debit card.

On the other hand, credit card gives you greater accessibility to funds. They offer interest-free loan, and some cards may even offer discounts and reward points on international flight bookings, hotels and waive off certain charges on international transactions for their customers.

A forex card is a prepaid travel card that you can load with a foreign currency of your choice. You can use a forex card just like a credit or debit card to pay for your expenses in a local currency abroad. You can even withdraw local cash from an ATM.

Are they cheaper than using debit or credit cards?

They are a cheaper alternative to credit or debit cards because a debit or credit card requires the cardholder to pay a currency conversion charge each time the card is used. “This is due to the fact that the card issues payments in Indian Rupees, which then has to be converted into the currency of the country the cardholder is in. This conversion charge, called a cross currency mark-up is between 2-5%, depending on the type of card and the issuing bank,” said BankBazaar.

A forex card comes with two main variants–multicurrency forex cards and single currency cards. A single currency card has limited use, and you will incur higher cross-currency charges if you use it in another currency. “A multicurrency card can travel with you wherever you go. You can load it with up to 23 currencies and use it across the world. You can also shuffle funds from one currency to another whenever you need via prepaid NetBanking — for example, if you are visiting two countries which have different currencies,” said HDFC.

So, while prepaid Forex cards do not carry a forex mark-up fee, for transactions where the transaction currency is different than the currency available on Multicurrency Forex Card, the bank charges cross currency markup of around 2% on such transactions. In such a scenario, where you are travelling to more than one country, opt for multi-currency forex cards.

The biggest advantage of a forex cards is that the foreign exchange conversion rate is locked as soon as you load the money in to it. But in the case of a credit card, the rates are applied at the time of the transaction, i.e., when you swipe your card. Therefore, whatever the prevailing rates are at that time will get applied along with other transactional charges.

What about privileges?

While credit cards are the most expensive option when it comes to cash withdrawals abroad, with the new changes in the tax collected at source rules, forex cards can actually make your foreign travels more expense. Recent amendments in the Foreign Exchange Management Act (FEMA) have brought international transactions made via credit cards, debit and forex cards under the Liberalised Remittance Scheme (LRS). From 1st July 2023, these transactions will also attract 20 per cent TCS. The only exception is that international credit and debit card spends outside India up to Rs 7 lakh shall be excluded from LRS. Hence no TCS shall be applicable on payments made by international credit and debit cards up to Rs 7 lakh in a financial year. But the government has not yet provided any specific clarification on the threshold limits for applicability of TCS on forex cards and cash exchanges

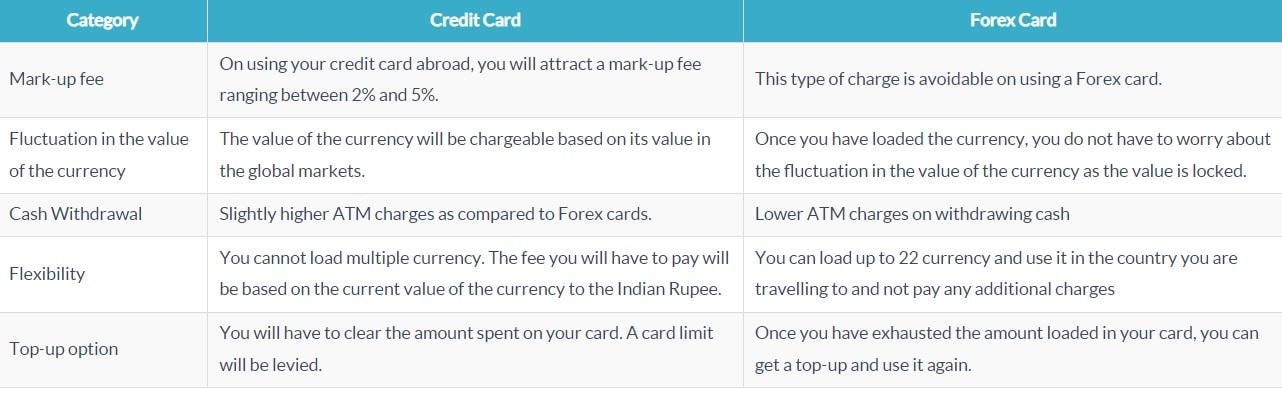

Difference between credit cards and forex cards, according to BankBazaar

Tell me about RuPay cards

Launched in 2012 by the National Payments Corporation of India, RuPay cards are issued by more than 1,100 banks including state-owned lenders, private banks, regional rural and cooperative banks. RuPay has been promoted by the government as India’s homegrown card network. Currently, you can purchase RuPay debit cards, RuPay credit cards, and prepaid cards. RuPay cards are available as per variants in these formats — Government schemes, classic, platinum, global and select. RuPay forex cards are next in line.

The RuPay JCB Global card can be used at RuPay card accepting points in India and JCB card accepting points outside India for PoS, E-Commerce and ATM.

“The regulator’s announcement to allow Indian banks to issue RuPay Prepaid Forex cards for overseas usage is a significant advancement in facilitating smooth cross-border transactions. This development enhances convenience, cost efficiency, and security, empowering individuals and businesses to engage in cross-border payments with ease. The widespread adoption of RuPay cards abroad supports the Government of India’s vision of a digital economy, promoting digital payments, financial inclusion, and overall economic growth,” said Akash Sinha, Co-Founder & CEO, Cashfree Payments.

The RBI decision comes in view of RuPay Debit and Credit cards issued by banks in India gaining international acceptance through bilateral arrangements with international partners and co-badging arrangements with international card schemes.

“RuPay forex cards, like other Rupay cards, will be issued by Indian banks in partnership with NPCI. Fees on RuPay cards may also differ compared to their counterparts. This is because RuPay operates on a domestic payment network, unlike other issuers operating on an international network,” said Adhil Shetty, CEO of BankBazaar.com.

“The launch of RuPay cards aligned with India’s vision of creating a more inclusive and self-reliant financial system while promoting digital payments and boosting domestic economic growth. RuPay has made significant strides in establishing itself as a credible alternative, particularly within the Indian market. Over the years, the acceptance of RuPay cards has expanded significantly, and it has now gained acceptance at many international locations as well. RuPay cards were designed to cater to the specific needs and preferences of Indian consumers. With the introduction of RuPay Prepaid Forex cards, payment options for Indians travelling abroad have further expanded. Moreover, with RuPay Debit, Credit, and Prepaid Cards for international use enabled for issuance in foreign jurisdictions, the competitiveness of RuPay as a viable payment option will be consolidated further,” said Shetty.

Still a lot of uncovered ground

While the Government has been pushing to expand the cross-border acceptance of RuPay cards, there is still a lot of uncovered ground.

“Customers must thoroughly assess the acceptance of the RuPay network in the countries where they plan to visit. RuPay prepaid forex cards promise acceptance across overseas ATMs, PoS machines, and online merchants. However, customers should carefully understand the charges for ATM withdrawals and balance enquiries, as these could be far more expensive than using a debit card at a domestic ATM,” said jinkya Kulkarni, Co-Founder and CEO, Wint Wealth.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India