RBI expected to pause again with markets watching for shift in stance

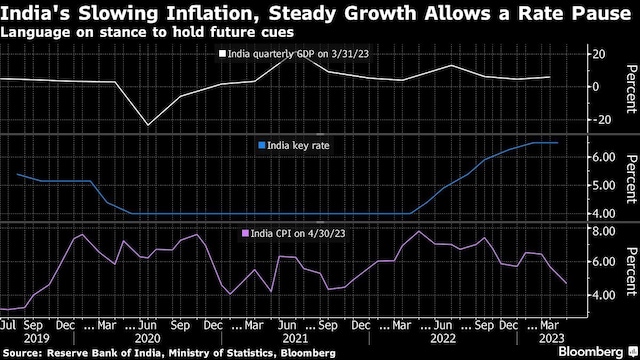

The Reserve Bank of India is expected to pause for a second straight month as inflation eases and market watchers are looking for cues of a shift in policy stance to support growth in Asia’s third largest economy.

Thirteen economists expect the monetary policy committee to retain “withdrawal of accommodation” language in the statement, while three saw a dilution in the phrasing and the remaining two estimate a shift to neutral. The rest of the economists didn’t share their forecasts.

“Amid steady growth and falling inflation, RBI can opt to watch global events unfold from the sidelines, especially given India’s improved macro stability,” said Rahul Bajoria, economist at Barclays Plc. “That should enable the full transmission of earlier policy rate hikes without necessarily being very disruptive.”

Here’s what to watch as RBI Governor Shaktikanta Das announces the decision at 10 a.m. in Mumbai, and addresses a press conference at noon:

The central bank governor warned last month that there was “no room for complacency” even if inflation has moderated. Kaushik Das, economist with Deutsche Bank AG, said the RBI may trim its inflation forecast to 5% from 5.2% in its last review, while retaining a 6.5% growth target in the current fiscal year.

While the stock for food, cereals and sugar are at comfortable levels going into the monsoon season, deficient rains can complicate inflation management said Pranjul Bhandari, India economist at HSBC Holdings Plc. “As such, the war against inflation hasn’t been fully won,” she added.

Predicting the point at which the RBI will be comfortable in changing the stance is becoming difficult given the differing interpretations of the monetary policy committee members. In April, five of them voted to stay focused on the withdrawal of accommodation while Jayanth Varma — one of the most vocal rate-setters of the group — expressed reservations on this.

Other economists say a change to neutral is justified. “A neutral stance will signal, that the RBI can hike, pause or cut at a future stage, as guided by the data and transmission lags,” Deutsche Bank’s Das said.

We expect the RBI to keep the repo rate on hold at 6.5% at its June 8 meeting, but make a dovish pivot by switching its stance to neutral from accommodation withdrawal. That would be a response to unexpectedly sharp disinflation in March and April.

Liquidity

The rates have subsequently eased amid bond redemption inflows, the RBI’s move to withdraw the highest value notes from circulation and its bumper dividend payment to the government. That’s removed any immediate need for a cash reserve ratio cut or the need for open market bond purchases by the central bank, according to State Bank of India analysis.

“With strong GDP data and moderating inflation, RBI is likely to adopt a non-committal wait-and-watch, look before you leap kind of cautious approach,“ said Sandeep Bagla, chief executive at Trust Mutual Fund. “Traders will look to find any signs of decisiveness, and are very unlikely to find any.”

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India