How to book train insurance for less than a rupee, claim up to Rs 10 lakh

While Railway Minister Ashwini Vaishnaw has announced an ex gratia payment of Rs 10 lakh in case of death, Rs 2 lakh for the grievously injured and Rs 50,000 for those with minor injuries following the triple train crash in Balasore district of Odisha on June 2, not everyone is aware about the travel insurance passengers can opt for by paying only Rs 0.35 while booking tickets on IRCTC.

The Indian Railway Catering and Tourism Corporation (IRCTC) provides an optional travel insurance policy for passengers buying tickets from its online portal. For e-ticket passengers, the policy provides cover in case of injury or death during a train journey.

The traveller has to select the insurance option at the time of booking ticket. Note that once the ticket has been booked you cannot choose insurance.

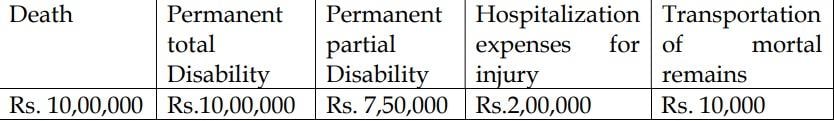

Through this facility, IRCTC provides insurance coverage of up to Rs 10 lakh to its passengers.

If the passenger suffers permanent partial disability, then he or she is given Rs 7.5 lakh as compensation. In case of an injury arising out of the accident, hospitalisation expenses to the tune of Rs 2,00,000 is paid for and Rs 10,000 is paid in case of transportation of mortal remains.

The scheme is applicable only for Indian Citizens who book their e-ticket through NGeT Website Application only. Citizen of foreign countries are not eligible for this scheme.

-

The scheme is optional, however if the option is exercised it will be compulsory for all passengers booked under one PNR number. -

Optional Travel Insurance facility is provided only for CNF/RAC/Part CNF ticket at the time of booking. -

Customer shall receive the policy information through SMS and on their registered email IDs directly from Insurance Companies along with the link for filling nomination details. However, Policy number can be viewed from Ticket booked history at IRCTC Page. -

After the booking of ticket, the nomination details to be filled at respective Insurance Company site. -

If nomination details is not filled then the settlement shall be made with legal heirs, if the claim arises. -

The coverage for the policy shall be for each passenger under the PNR in case of Death, Permanent Total Disability, Permanent Partial Disability, and Hospitalization Expenses for Injury and Transportation of mortal remains following Rail Accident or untoward incident.

Children under the age of 5 are not covered

Which insurance company will be liable?

Travel insurance scheme is uniform

Train insurance is uniform across classes

What is covered under the scheme:

Up to Rs 7.5 lakh in case of permanent partial disability

Death:

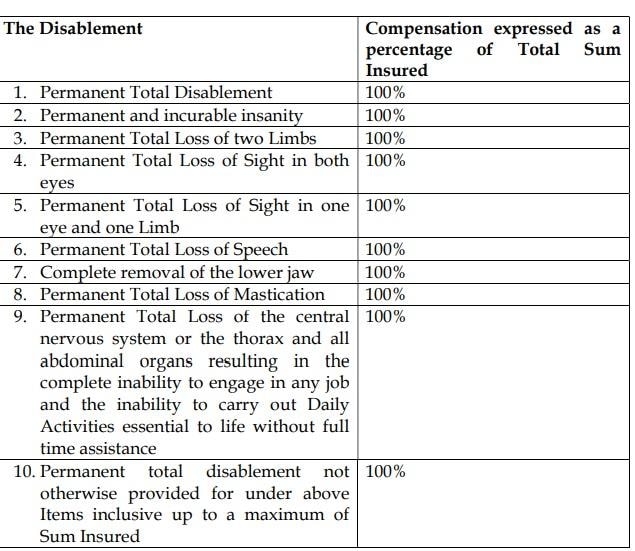

Permanent disability:

Permanent disability

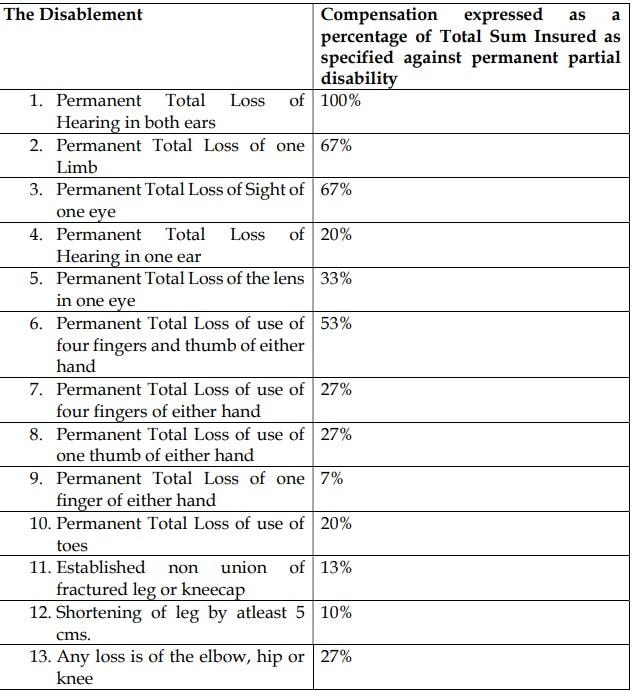

If the Insured sustains accidental bodily injury during the Trip that directly and independently of all other causes results in permanent partial disability within 12 months of the date of the accident or untoward incident, 75% of the Sum Insured is payable.

The Insurance Company shall indemnify the Insured for the expenses, upto Rs2 lakh, incurred by the Insured for Hospitalization and medical treatment, taken on account of any Injury sustained by the Insured whilst

The Medical Expenses incurred for Hospitalization Treatment will include:

b. Nursing,

d. Medical Practitioner,

f. Medicines, drugs and consumables,

h. The cost of prosthetic and other devices or equipment if implanted internally during a Surgical Procedure.

j. A Hospital means any institution established for inpatient Care and Day Care treatment for illness and/or injuries and which has been registered as a Hospital with the local authorities

Transportation of mortal remains:

Claims Procedure & Documentation

The Insured or his nominee or legal heir shall tender to the Insurance Company all reasonable information, assistance and proofs in connection with any claim hereunder.

Documents required for death claim:

Submit the duly filled in claim form signed by nominee/legal heir along with the NEFT mandate details and cancelled cheque with the following documents:

• Report of the Railway Authority carrying the details of the passengers

• Duly Completed Personal Accident Claim Form signed by Nominee / Legal

Heir along with the NEFT mandate details & cancelled cheque

• Photo identity proof of nominee

of buying insurance through IRCTC portal

Heir / Succession Certificate

• Report of the Railway Authority confirming the accident of the train or untoward incident

• Medical bills corresponding to doctor’s prescription.

• Attested copy of disability certificate from Civil Surgeon of that Hospital in which the treatment has undergone stating percentage of disability.

• All X-Ray / Investigation reports and films supporting to disablement.

• Claim form with NEFT details & cancelled cheque of the beneficiary

• Photograph before & after disability

Report of the Railway Authority confirming the accident of the train or untoward incident

Advance and final receipts (All receipts shall be numbered, signed an stamped)

Diagnostic Test Reports, X Ray, Scan, ECG and others including doctor’s advice demanding such tests)

Where do the claim documents have to be sent?

Claims Settlement / Rejection

2. The Insurance Company shall be released from any obligation to pay insurance benefits if any of the obligations are breached

4. The Insurance Company shall be liable to pay any interest at 2% above the bank rate prevalent at the beginning of the financial year in which the claim is reviewed, for sums paid or payable under this Policy, upon acceptance

5. No Claim is admissible beyond 365 days from date of expiry of the policy in respect of hospitalization commencing within the Period of Insurance.

7. At the time of claim settlement, Insurance Company may insist on KYC documents of the insure/nominee/legal heir as per the relevant AML guidelines in force

Alternatively, you can purchase travel insurance on your own to ensure that you are covered for any unforeseen circumstances that may arise during your journey. However, the decision to purchase travel insurance is a personal one. Consider factors such as the length of the journey, the route, and assess the value of the belongings you are carrying with you.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India