Surge in demand, falling liquidity to lead to credit tightening: Report The drop in banking system liquidity and the concurrent rise in demand for credit may result into tightening of credit in the financial system, a report said on Wednesday. The liquidity condition is expected to become even more challenging over the coming months, owing to an expected ...

Read More »Finance News

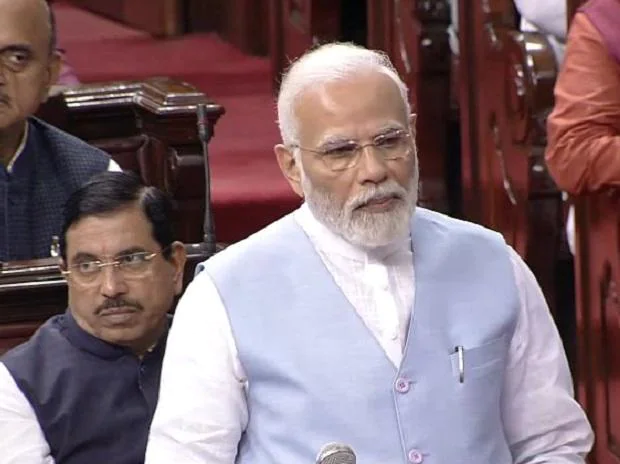

Rs 50,000 cr forex saved by blending ethanol with petrol in 7-8 years: PM

Rs 50,000 cr forex saved by blending ethanol with petrol in 7-8 years: PM Prime Minister Narendra Modi on Wednesday said the country saved Rs 50,000 crore in foreign exchange by blending ethanol with petrol in the last seven-eight years. Dedicating the second-generation ethanol plant of India Oil Corporation to the nation here, Modi said that the same ...

Read More »RBI cancels Rupee Co-operative’s licence; lender to cease business Sep 22

RBI cancels Rupee Co-operative’s licence; lender to cease business Sep 22 The Reserve Bank of India (RBI) on Wednesday cancelled the licence of the Rupee Co-operative Bank, saying the Pune-based lender does not have adequate capital, earning prospects and it does not comply with regulations. Rupee Co-operative will cease to conduct business from September 22. Maharashtra’s Commissioner for ...

Read More »Loans for bad credit with no credit check from top financial services in 2022

Loans for bad credit with no credit check from top financial services in 2022 Anyone can find themselves in a difficult financial situation. On top of that, having a low credit score as a result of a financial crisis may make things even worse. However, you need not fear because some lenders are now offering loans even for bad ...

Read More »SBI, Bank of Baroda may look to raise Rs 8,000 cr through bond sale

SBI, Bank of Baroda may look to raise Rs 8,000 cr through bond sale Country’s largest lender State Bank of India may look to raise funds worth Rs 4,000 crore through issuance of tier-II bonds once it completes its planned sale of Rs 7,000 crore worth of additional tier-I (AT-1) bonds at the end of this month, sources said. ...

Read More »RBI to implement some recommendations of working group on digital lending

RBI to implement some recommendations of working group on digital lending The RBI has accepted some recommendations made by the working group on digital lending (WGDL), effective immediately. Here are a few of the key recommendations: * Loan disbursals and repayments can only happen between the bank accounts of borrowers and an RBI-regulated entity without any pass-through. ...

Read More »RBI categorises digital lenders into three groups, releases guidelines

RBI categorises digital lenders into three groups, releases guidelines After a long wait, the Reserve Bank of India (RBI) on Wednesday released the digital lending guidelines based on the principle that lending business can be carried out only by entities that are either regulated by the central bank or entities permitted to do so under any other law. The ...

Read More »FY23’s interest coverage ratio likely to deteriorate: Bank of Baroda study

FY23’s interest coverage ratio likely to deteriorate: Bank of Baroda study The interest payments of the companies is going to increase going forward because interest rates are expected to go up in the rising rate cycle where the Reserve Bank of India (RBI) has already front loaded 140 basis points hike in policy rate. Interest payments will also ...

Read More »ICICI Bank, PNB, Bank of Baroda lift loan rates post RBI rate hike

ICICI Bank, PNB, Bank of Baroda lift loan rates post RBI rate hike Following a 50-basis-point rate hike by the Reserve Bank of India (RBI), private lender ICICI Bank and state-owned Punjab National Bank and Bank of Baroda raised lending rates. On Friday, the RBI’s Monetary Policy Committee raised the repo rate to 5.40 per cent from ...

Read More »Rupee falls as strong US jobs data rekindles fear of aggressive Fed hikes

Rupee falls as strong US jobs data rekindles fear of aggressive Fed hikes The Indian rupee weakened sharply versus the dollar on Monday as a stronger-than-expected US jobs report rekindled concerns over aggressive rate hikes by the Federal Reserve, dealers said. At 10:00 am IST, the rupee was trading at 79.54 per dollar as against 79.25 per dollar at ...

Read More » Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India