Bank union opposes public sector banks’ ‘loan melas’ on NPA pile-up fears The Maharashtra State Bank Employees Federation (MSBEF) on Monday opposed ‘loan melas’ organised by state-owned banks, saying that credit granted without much diligence at such events lead to pile-up of non-performing assets. Such ‘melas’ add to the retail Non-Performing Assets (NPAs) for the lenders as ...

Read More »Finance News

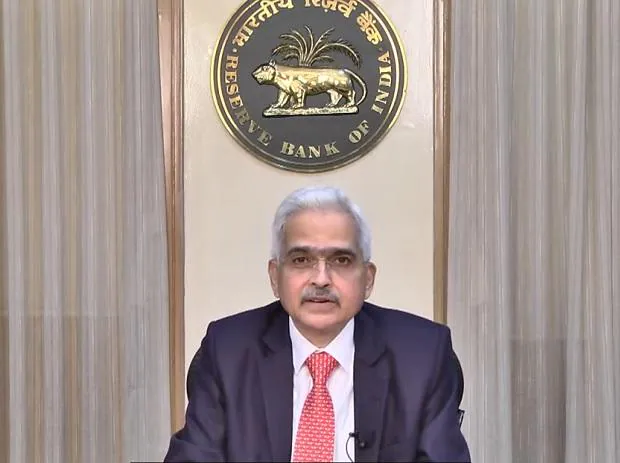

Banks, financial markets strong enough to withstand extreme volatility: Das

Banks, financial markets strong enough to withstand extreme volatility: Das Reserve Bank Governor Shaktikanta Das on Monday said despite the latest headwinds arising from the Jackson Hole summit leading to extreme volatility, our banking system and financial markets are strong enough to withstand such pressures. Taking the markets by surprise, US Fed chair Jerome Powell had told ...

Read More »Maharashtra state bank employees union protests govt loan melas

Maharashtra state bank employees union protests govt loan melas The federation’s secretary, said in a statement the Congress government before “distributed hundreds of crores” by organising loan melas and now the present government is on the same lines

Read More »Rupee held its own despite sharp depreciation in other currencies: RBI Guv

Rupee held its own despite sharp depreciation in other currencies: RBI Guv Despite extreme volatility in global stock markets, especially after US Federal Reserve chairman Jerome Powell’s Jackson Hole symposium remarks last week, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Monday that the Indian rupee has “held its own” and moved in an “orderly manner at ...

Read More »HSBC Bank Mauritius sells 7% shares of V-Mart Retail for Rs 392 cr

HSBC Bank Mauritius sells 7% shares of V-Mart Retail for Rs 392 cr HSBC Bank Mauritius on Monday offloaded 13.91 lakh shares of retail company V-Mart Retail for Rs 392 crore through an open market transaction. According to the bulk deal data available with the BSE, HSBC Bank Mauritius Limited AC Jwalamukhi Investment Holdings sold 13,91,826 shares, ...

Read More »RBI imposes penalties on five co-operative banks for non-compliance

RBI imposes penalties on five co-operative banks for non-compliance The Reserve Bank has imposed penalties on five cooperative banks, including Rs 25 lakh on The Karnataka State Co-operative Apex Bank, Bengaluru, for deficiencies in regulatory compliance. The penalty on The Karnataka State Co-operative Apex Bank Ltd has been imposed for non-compliance with directions on “Housing Finance”, the ...

Read More »HDFC Bank, Precision Bio to test applications under RBI’s sandbox scheme

HDFC Bank, Precision Bio to test applications under RBI’s sandbox scheme HDFC Bank and Precision Biometric India have been selected by the Reserve Bank for testing their ‘on tap’ retail payments applications under the regulatory sandbox scheme, the central bank said on Monday. Regulatory sandbox (RS) refers to live testing of new products or services in a ...

Read More »NTT DATA Payment Services gets RBI nod for payment aggregator license

NTT DATA Payment Services gets RBI nod for payment aggregator license Payment service provider NTT DATA Payment Services India (earlier Atom Technologies) on Monday said it has received an in-principle approval from the Reserve Bank of India (RBI) for the Payment Aggregator (PA) license. The company has an annual transaction value of Rs 150,000 crore and a ...

Read More »CSB Bank to seek shareholders’ nod to extend interim MD & CEO Mondal’s term

CSB Bank to seek shareholders’ nod to extend interim MD & CEO Mondal’s term Indian origin Canadian billionaire Prem Watsa’s Fairfax India Holdings promoted CSB Bank will seek shareholders’ nod later this month to extend interim head Pralay Mondal’s term till a regular MD & CEO is appointed. CSB Bank will seek shareholders’ nod for Mondal’s appointment ...

Read More »Indiabulls Housing Finance to raise Rs 1,000 cr via public issue of bonds

Indiabulls Housing Finance to raise Rs 1,000 cr via public issue of bonds Indiabulls Housing Finance Ltd plans to raise up to Rs 1,000 crore, which includes Rs 900 crore through issue of public issue bonds. The Tranche II Issue offers various series of NCDs for subscription with coupon rates ranging from 8.33 per cent to 9.55 ...

Read More » Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India