Buyer preference for bigger, premium homes is big win for these 11 builders

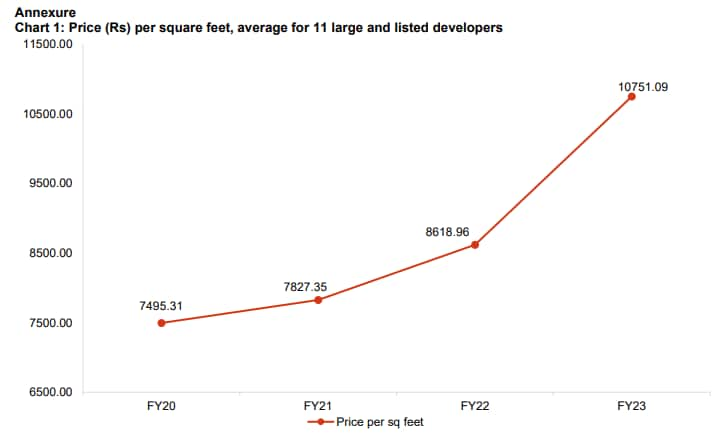

Buoyant residential demand across the mid, premium and luxury segments has already resulted in robust sales growth in the

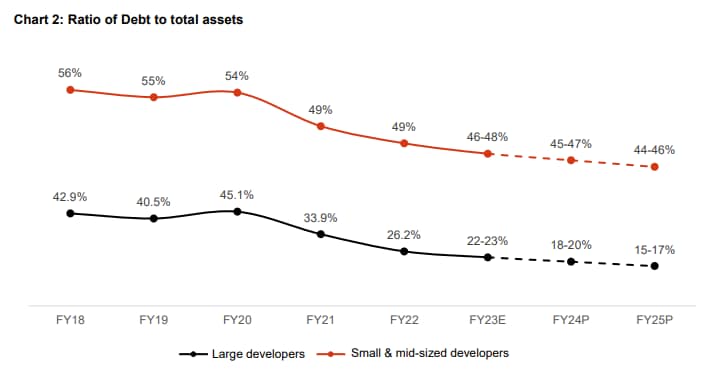

A rating study of 11 large and listed and 76 small and mid-sized residential developers, accounting for 35% of the residential sales in the country, indicates that leverage and credit profiles of developers had strengthened, too, and should sustain over

The 11 large and listed realtors in the sample set are Brigade Enterprises, DLF, Godrej Properties, Kolte-Patil Developers, Macrotech Developers, Mahindra Lifespace Developers, Oberoi Realty, Prestige Estates Projects, Puravankara, Sobha, Sunteck Realty.

According to Crisil, these large developers are well poised to increase their market share to 30% this fiscal from 16-17% in fiscal 2020, enabled by continued strong sales and collections from their ongoing projects, easier access to bank finance and capital markets, and increasing consumer preference towards reliable and reputed brands.

“Healthy economic growth and offices continuing with hybrid working model is keeping demand for residential real estate steady this fiscal, especially for bigger and premium residences. This demand is expected to hold firm at 8-10% despite rise in interest rates and capital values for the aforesaid reasons,” said Aniket Dani, Director, CRISIL Market Intelligence & Analytics.

Delhi NCR, Chennai, Mumbai Metropolitan Region, and Bengaluru lead in terms of total land area transacted (about 1,576 acres), accounting for a 72 percent share. With a development potential of around 150 msf, the land was acquired in 79 separate deals.

“Over 100 land transactions with a development potential of 209 million sq ft in the last 17 months is a visible indication of the positive sentiment for the real estate sector. Interestingly, most of the land transactions were for residential development due to the surge in demand,” said Samantak Das, Chief Economist and Head of Research and REIS, JLL India.

Fresh real estate launches across India’s top seven cities grabbed a 41% share in first quarter of 2023, marking an increase from the 26% recorded in the same period four years ago, according to a report released by property consultancy firm Anarock last month.

However, these smaller players rely more on debt and may need to tie up with larger developers for new launches to benefit from the latter’s superior execution ability, strong balance sheets and reputation of quality consistent with the brand image.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India