Travel now, pay later vs credit card vs personal loan: Which to opt for? [ad_1] What is travel now, pay later? TNPL is the travel version of ‘buy now, pay later’ scheme, wherein you purchase merchandise and pay for it through EMIs. It is essentially a loan or credit you are taking while booking or taking a trip and staggering ...

Read More »Blog

Rupee depreciates 8 paise to 79.82 against US dollar in early trade

Rupee depreciates 8 paise to 79.82 against US dollar in early trade The rupee depreciated by 8 paise to 79.82 against the US dollar in opening trade on Wednesday as investors await the US Fed’s policy decision on interest rates for further cues. Forex traders said the strength of the American currency in the overseas ...

Read More »India's banking system liquidity slips into deficit after 40 months: RBI

India's banking system liquidity slips into deficit after 40 months: RBI India’s banking system liquidity has slipped into deficit for the first time in nearly 40 months, according to the Reserve Bank of India

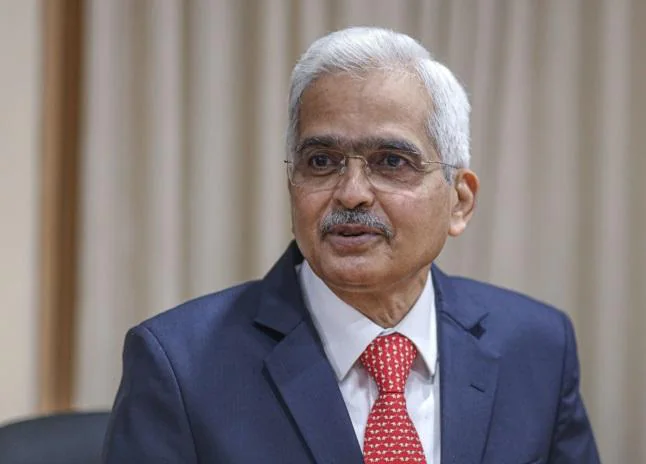

Read More »RBI wants fintech operators to follow rules of game: Shaktikanta Das

RBI wants fintech operators to follow rules of game: Shaktikanta Das Governor Shaktikanta Das on Tuesday said the RBI will not stifle or penalise fintech companies, but wants them to follow the “traffic rules” where their innovations adhere to certain expectations from the regulator. The innovations that come out have to enhance the efficiency and ...

Read More »RBI removes Central Bank of India from PCA framework after more than 5 yrs

RBI removes Central Bank of India from PCA framework after more than 5 yrs Reserve Bank of India today removed the Central Bank of India from the Prompt Corrective Action (PCA) framework on complying with parameters like net non-performing assets (net NPAs) and capital ratios. While removal paves way for normal functioning for business growth, ...

Read More »Rupee rises 7 paise to close at 79.74 against dollar ahead of Fed meet

Rupee rises 7 paise to close at 79.74 against dollar ahead of Fed meet The rupee consolidated in a narrow range and settled 7 paise higher at 79.74 against the US dollar on Tuesday, snapping its four-session falling streak as investors await the US Fed’s policy statement for further cues. At the interbank forex market, ...

Read More »Overall credit market grows 11.1% to Rs 174.3 trn in FY22: Report

Overall credit market grows 11.1% to Rs 174.3 trn in FY22: Report Led by a 122 per cent spike in retail loan volume, the overall credit market grew 11.1 per cent in FY22 over the previous year to Rs 174.3 lakh crore, according to a credit bureau report. According to credit bureau CRIF High Mark, ...

Read More »Big Tech in financial system poses concentration risk: Shaktikanta Das

Big Tech in financial system poses concentration risk: Shaktikanta Das The increasing involvement of Big Tech in the financial system could give rise to concentration risk and there are potential spillovers, which call for closer attention, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Tuesday. “…enormous amounts of consumer data is being generated ...

Read More »Yes Bank to sell stressed assets worth Rs 48k cr to JC Flowers ARC

Yes Bank to sell stressed assets worth Rs 48k cr to JC Flowers ARC Yes Bank on Tuesday said its board has approved the sale of stressed assets worth around Rs 48,000 crore to JC Flowers ARC, which has turned out to be the sole bidder for the portfolio. The US-based asset reconstruction company (ARC) ...

Read More »India’s fintech market to reach $1 trillion by 2030: Chief Economic Advisor

India’s fintech market to reach $1 trillion by 2030: Chief Economic Advisor India’s fintech market is expected to reach $1 trillion by 2030, from $31 billion in 2021, Chief Economic Advisor Dr V. Anantha Nageswaran said here on Tuesday. Speaking at the ‘Global Fintech Fest 2022’ (GFF 2022), he noted that a major shift towards ...

Read More » Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India