5 top NFT projects to buy in 2022 for long-term high returns [ad_1] Finding the top NFTs to buy in this bear market can be pretty challenging. It’s even harder to find NFT projects with detailed road maps that will lead to long-term returns for the NFT holders. However, there are still a strong handful of projects worth keeping on ...

Read More »Blog

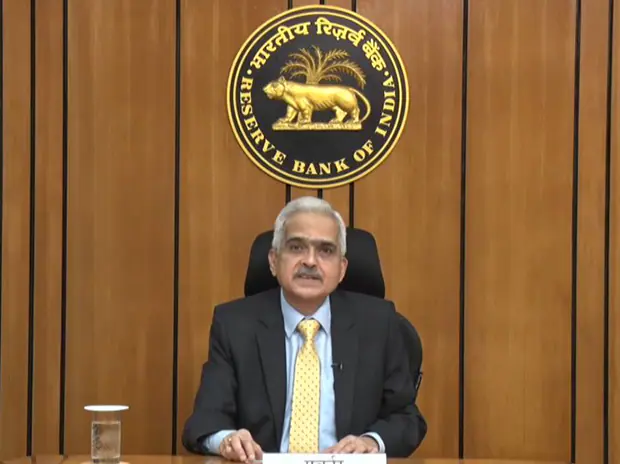

RBI aims to bring down inflation to 4% in two years: Shaktikanta Das

RBI aims to bring down inflation to 4% in two years: Shaktikanta Das The Reserve Bank of India (RBI) aims to reduce inflation to its medium-term target of 4 per cent in the next two years and its rate actions will be data dependent, said governor Shaktikanta Das on Tuesday. Consumer Price Index-based inflation—the central bank’s monetary ...

Read More »RBI set to hike interest rates by another 50-60 bps, inflation key concern

RBI set to hike interest rates by another 50-60 bps, inflation key concern The minutes of the August 22 Monetary Policy Committee of the RBI highlights that inflation continues to remain the key concern for the MPC members despite a deceleration in the overall price momentum after a peak of 7.8 per cent recorded in April, Acuite Ratings said ...

Read More »Investors: ‘Investors could look to lock in money into corporate FDs’

Investors: ‘Investors could look to lock in money into corporate FDs’ [ad_1] Mumbai: Investors could start locking their money into long-term fixed deposits with tenures of three to five years, said distributors. While deposit rates across the board have gone up by 50-75 basis points in the past nine months, the pace of rate increases could slow in the coming ...

Read More »Banks must ensure credit schemes reach eligible citizens: FM Sitharaman

Banks must ensure credit schemes reach eligible citizens: FM Sitharaman Finance Minister Nirmala Sitharaman on Tuesday asked banks to serve eligible beneficiaries of government credit-related schemes. Sitharaman, who was at a credit outreach programme in Nagaland, said the trouble phone banking had caused lenders now appeared over. “Indian banks have come out of a very troubled five ...

Read More »sovereign gold bond investments: Can you take a loan against your Sovereign Gold Bond investments?

sovereign gold bond investments: Can you take a loan against your Sovereign Gold Bond investments? [ad_1] The second tranche of the Sovereign Gold Bonds (SGB) opened for subscription on August 22 and will close on August 26, 2022. The RBI issues SGBs on behalf of the government of India at a set issue price. The Gold Bonds issued under this ...

Read More »Rupee worries force India’s importers to hedge extra: An analysis

Rupee worries force India’s importers to hedge extra: An analysis Worried about India’s precarious external accounts and the weakening rupee, domestic importers are hedging a lot more of their currency exposures than they are required to. The rupee is down about 7.5% versus the U.S. dollar this year, and headed for what could be its worst year in four. ...

Read More »Three banks offering FD interest rate over 8% for senior citizens

Three banks offering FD interest rate over 8% for senior citizens [ad_1] Ever since the Reserve Bank of India (RBI) started hiking key policy rates in May 2022, banks have been increasing interest rates on fixed deposits (FDs). Some banks have hiked interest rates so much that they have risen from decadal low levels to close to 8% for senior ...

Read More »Rupee seen firming to 78.5-79.5 against dollar by FY23-end: HDFC Bank

Rupee seen firming to 78.5-79.5 against dollar by FY23-end: HDFC Bank By Anushka Trivedi MUMBAI (Reuters) – The Indian rupee is likely to strengthen to 78.50-79.50 against the dollar by March 2023, as commodity prices stabilise globally and improving domestic fundamentals lure back foreign portfolio inflows, the country’s top private lender HDFC Bank said. The rupee has ...

Read More »Sovereign Gold Bonds : How is investment in Sovereign Gold Bonds taxed?

Sovereign Gold Bonds : How is investment in Sovereign Gold Bonds taxed? [ad_1] What is the SGB issue price? “ The nominal value of the bond based on the simple average closing price [published by the India Bullion and Jewellers Association Ltd (IBJA)] for gold of 999 purity of the last three working days of the week preceding the subscription ...

Read More » Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India