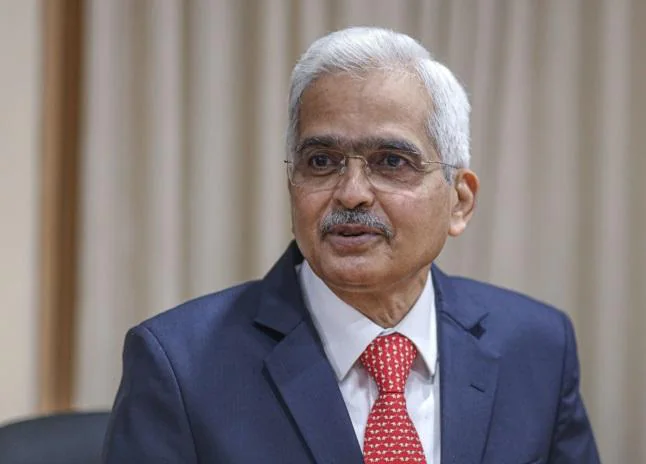

RBI to publish paper on expected loss-based approach for loan provisioning The Reserve Bank of India (RBI) wants banks to adopt the expected credit loss (ECL) regime for provisioning of loan assets and it will shortly come out with a discussion paper on the transition, said Governor Shaktikanta Das on Friday. Banks in India are currently required ...

Read More »Blog

SCSS Interest rate: Senior Citizens’ Savings Scheme: Govt clarifies on interest rate payable after death of SCSS account holder

SCSS Interest rate: Senior Citizens’ Savings Scheme: Govt clarifies on interest rate payable after death of SCSS account holder [ad_1] The Ministry of Finance, said in a press release issued on September 29, 2022, that it has been observed that when a Senior Citizens’ Savings Scheme (SCSS) account holder passes away, the operating agencies close the account and consider it ...

Read More »More rate hikes, eye on rupee: How experts interpret RBI’s 50-bps rate hike

More rate hikes, eye on rupee: How experts interpret RBI’s 50-bps rate hike The Reserve Bank of India (RBI) governor, Shaktikanta Das’, reiteration that the Indian economy remains resilient in the face of a third global shock, boosted investor sentiment on Dalal Street. Besides, the Monetary Policy Committee’s (MPC’s) 50-basis point (bps) rate hike, in-line with expectations, cheered investors. ...

Read More »Offline payments aggregators can’t store your debit, credit card details now

Offline payments aggregators can’t store your debit, credit card details now [ad_1] Offline payment aggregators such as those entities aggregating offline credit and debit card payments e.g swipes at physical merchant stores, will now be subject to the same government rules as applicable to online payment aggregators. Offline payments means those payments where both merchant and customers are present to ...

Read More »RBI Policy: Repo rate up by 50 bps to 5.9%; accommodative stance withdrawn

RBI Policy: Repo rate up by 50 bps to 5.9%; accommodative stance withdrawn The Reserve Bak of India (RBI) raised the policy repo rate by 50 basis points (bsp) to 5.9 per cent in its monetary policy review. This is the fourth hike in repo rate in the current financial year. In its Monetary Policy Committee meeting (MPC), the ...

Read More »PSBs asked to expedite recruitment, fill vacancies in time-bound manner

PSBs asked to expedite recruitment, fill vacancies in time-bound manner The finance ministry has asked public sector banks (PSBs) to expedite the process of filling pending vacancies, sources said. The ministry had reviewed the vacancies in PSBs earlier this month and advised them to take action to fill them. Finance Minister Nirmala Sitharaman on Tuesday had ...

Read More »Banks increase interest rates on bulk deposits as liquidity tightens

Banks increase interest rates on bulk deposits as liquidity tightens With surplus liquidity in the system shrinking and deposit growth trailing credit growth by a large margin, banks have hiked interest rates on bulk deposits, suggesting that they are looking for such deposits to meet the credit demand. Rates on three-month corporate deposits are in the range ...

Read More »HDFC Bank: Can a small finance bank be the next HDFC Bank in the making for equity investors?

HDFC Bank: Can a small finance bank be the next HDFC Bank in the making for equity investors? [ad_1] The banking landscape in India changed when the sector was opened up in the ’90s. Not only did it benefit customers by giving them access to world-class products and services, it was also the start of a rewarding journey for equity ...

Read More »Fall in forex reserves due to rupee depreciation not worrying, say experts

Fall in forex reserves due to rupee depreciation not worrying, say experts The decline in foreign exchange reserves of the country due to the depreciation of the rupee is not a worrying factor, and there is coverage for nine months of imports, experts said here on Thursday. The country’s forex kitty continued its southward journey, with the ...

Read More »Small Saving Schemes: Govt hikes interest rates of only these small saving schemes for Oct-Dec 2022 quarter

Small Saving Schemes: Govt hikes interest rates of only these small saving schemes for Oct-Dec 2022 quarter [ad_1] After close to four years, the government has increased the interest rates of certain small savings schemes. According to a circular issued by the Finance Ministry on September 29, the interest rates of two small saving schemes have been hiked by up ...

Read More » Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India