Add-on options can save your vehicle from monsoon damage

Depending on the insurance policy, the insurance cover protects your car against the different damages. However, damages to the engine are not covered even under a comprehensive plan. That’s when you need to buy add-ons. Add-ons are additional yet optional policy features that enhance your policy’s coverage to include those perils that otherwise are not covered by a standard car insurance policy.

“With the onset of the monsoon season, the possibility of motor vehicles being damaged due to breakdowns or engine failures because of water ingression, slippery roads, hydroplaning, accidents resulting from reduced visibility, water logging and damage from falling trees or landslides is high. It is important for policyholders to understand that standard car insurance policies might not provide adequate coverage for these specific monsoon-related perils,” said Neel Chheda, Senior Executive Vice President & Head – Auto & Actuarial Analytics, Tata AIG General Insurance.

Here are the different add on policies car owners can explore

This feature is strongly recommended for areas which are prone to flood and waterlogging like Kolkata, Mumbai and Chennai.

24×7 Roadside Assistance add-on:This cover is useful in times of road emergency. This provides support with a vehicle towing facility in a waterlogged area. It also ensures that mechanical help reaches the policyholder on time and that their vehicle’s issues are fixed at an affordable price, explained Kumar.

A 24X7 roadside assistance (RSA) cover can be purchased to help you jump-start your vehicle or even tow it to the closest service garage. In addition, the RSA cover aids by providing emergency fuel, alternate key facility and even accommodation in some cases.

“The Road Side Assistance cover povides support to the customer in case of Break-down of the vehicle and provides on-site repair, Towing, alternate travel facility, fuel procurement support etc as per applicable plans.Price of Engine protect cover depends on the insured declared value of the vehicle along with other factors. Prices of Road Side Assistance cover cover may vary from as low as Rs. 199/- to more than Rs. 1000/- as per the plans opted. The benefits of these add-ons are very high in terms of value they provide compared to the price,” said Gaurav Arora, Head Corporate Underwriting & Claims at ICICI Lombard.

Zero Depreciation add-on: A must-have add-on during monsoon as it saves out-of-pocket expenses. The car owner can get full reimbursement for vehicle damages without accounting for the depreciation of the vehicle or its plastic, rubber and fibre parts. While zero depreciation covers all the vehicle components, there is 50% coverage for batteries, tyres and tubes.

Return to invoice add on: If the insurer finds that the vehicle is beyond repair due to cyclone, waterlogging or thunderstorm then the policyholder can claim the original invoice value of the vehicle instead of its depreciated value, said Policybazaar’s Kumar.

In case of theft or damage beyond repair, Return to Invoice Cover helps you claim the complete amount mentioned on the car’s invoice value. In this case, ACKO will compensate you with the amount written on the invoice, which includes car registration cost and road tax as well.

Add-ons imperative for those living in coastal and flood-prone areas

“For individuals residing in coastal and flood-prone locations, it becomes even more crucial to consider and opt for comprehensive protection. We recommend policyholders to ensure they have a valid motor insurance policy, carefully evaluate their needs and opt for appropriate add-ons. Some key add-ons to consider when selecting a motor insurance policy include engine Secure, tyre Secure cover, roadside assistance, consumables cover, and return to invoice cover, emergency transport and hotel expenses, and personal accident cover for own and for co-passengers,” said Chheda.

Do add-on covers affect the car insurance premium amount?

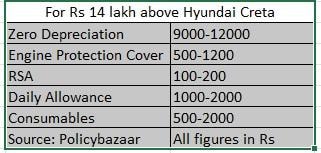

Approximate price for a popular car like a 5-year-old Wagon R (1061 CC) with Rs 2.5 lakh cover:

1. Zero Depreciation – average Rs. 2250 (Rs. 1500 to 3000)

2. Engine Protector – average Rs. 400 (Rs. 300 to 500)

3. 24×7 Roadside Assistance – average Rs. 150 (Rs. 100 to 300)

Source: Policybazaar

The above prices are on top of the comprehensive policy premium.

“One thing to note is that these add-ons are priced differently from insurer to insurer, depending on their claims data and customer profiles. Some insurers may price flood-prone areas very highly, while others can price them moderately depending on vehicle and customer history,” said Policybazaar’s Kumar.

Is there a different claim procedure if you buy these add-on covers?

The process remains similar to raising claims under the Standard Comprehensive car insurance policy. You will have to follow the procedure mentioned by the insurance company for any claim during the policy period.

Why is an add-on cover important?

While the third party plan covers you for injuries to someone else and damages to their property, the Own Damage plan covers liabilities arising from damages to your car. However, the Standard Comprehensive car insurance does not provide additional coverage such as engine-related repairs, breakdown in the middle of a road, etc. “For example, the Zero Depreciation add-on cover does not consider the depreciation value of the car parts replaced or repaired while settling claims. With this add-on, you can avoid paying from your pocket,” said ACKO Insurance.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India