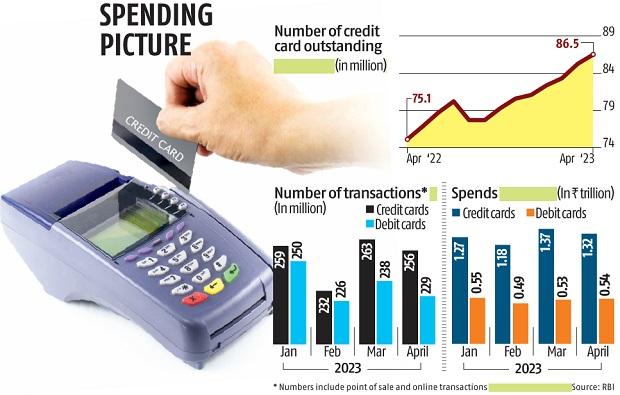

Credit cards are no longer an urban preserve. Credit cards in force (CIF) reached a record high in April this calendar year, with 86.5 million cards in circulation, as banks permeated tier II, III, and IV centres.

“Industry CIF increased by 1.2 million in April to reach an all-time high of 86.5 million,” said ICICI Securities in a note.

In terms of market share, the biggest gainer was Axis Bank, which benefited from the Citi acquisition.

“Axis Bank’s market share increased from 11.7 per cent in February to 14.2 per cent in April, led by its acquisition of Citi’s consumer business,” the note read.

SBI Card’s market share in terms of CIF declined from its recent high of 19.8 per cent in February to 19.5 per cent in April.

HDFC Bank’s CIF market share saw a marginal increase from 20.6 per cent in March to 20.7 per cent in April.

As issuers enter newer geographies and card acceptance among semi-urban users gains currency, credit card issuances see an uptick. As a result, both the use of credit cards and spending are higher than with debit cards.

According to the Reserve Bank of India data, the gap between the number of transactions using credit and debit cards has widened in recent months.

In January, there were 259 million credit card transactions and 250 million debit card transactions. In March and April, the number of credit card transactions was 263 million and 256 million, respectively. For debit cards, the numbers were 238 million and 229 million, respectively.

Monthly credit card spending is more than double that of debit cards. In April, total credit card spends was Rs 1.32 trillion, while debit card spends was Rs 54,000 crore.

“There are three reasons for the surge in credit card spending,” said Bikram Yadav, business head-credit cards, RBL Bank.

“One, issuances have gone up. Since the pandemic, there has been growth in new card issuances. Two, new categories that were not there earlier — utility payments and house rent payments — are now driving transactions. Three, online purchases have gone up in tier II, III, and IV cities, which are mostly done using credit cards,” Yadav told Business Standard.

Debit cards, which were 967 million in April, were 10x more than credit cards in force.

“Credit card spending transactions are outpacing debit cards. Probably, awareness among customers of credit cards is increasing. Credit cards are more rewarding; they have promotional schemes and reward points,” said Nitin Aggarwal, head of banking, insurance, and financial research, Motilal Oswal Institutional Equities.

Another reason for the surge in credit card spending is that, as Aggarwal pointed out, banks and card companies are issuing cards to the self-employed and not just the salaried class.

As credit cards gain usage in semi-urban areas, many consumers have substituted debit cards with credit cards for their purchases.

The biggest cannibalisation of debit cards has come from Unified Payments Interface (UPI), though.

“The biggest market-share movement has happened from debit cards to UPI. There could be some movement from debit to credit since credit cards have grown rapidly since the pandemic. But it is not large enough to cannibalise the debit card’s large base,” observed Yadav.

Even if spending is rising, most credit card users are not rolling over, which continues to stay below pre-Covid levels.

“Rollovers for credit cards have come down. Credit card companies want rollover to increase to pre-Covid levels. People are now careful spenders. Customers who pay on time have increased over the years. Equated monthly instalments and rollovers are growing at a very calibrated pace. They are lower than what they used to be before the pandemic,” said Aggarwal.

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India

Loan, Personal Loan, Home Loan, Business Loan,Loans in India Loan in India, Personal Loan, Home Loan, Business Loan, Loans in India,Loan Finance,Loan in India, Get Instant Personal Loan,Home Loan, Business Loans in India